Tyler Winklevoss says JPMorgan hit pause on Gemini’s try to revive banking entry after he publicly criticized the financial institution. In keeping with him, the choice got here shortly after he posted a tweet calling out main banks for preventing in opposition to open banking reforms. He believes the timing wasn’t a coincidence.

My tweet from final week struck a nerve. This week, JPMorgan advised us that due to it they had been pausing their re-onboarding of @Gemini as a buyer after they off-boarded us throughout Operation ChokePoint 2.0. They need us to remain silent whereas they quietly strive to remove your… https://t.co/c9Ls7QpAmT

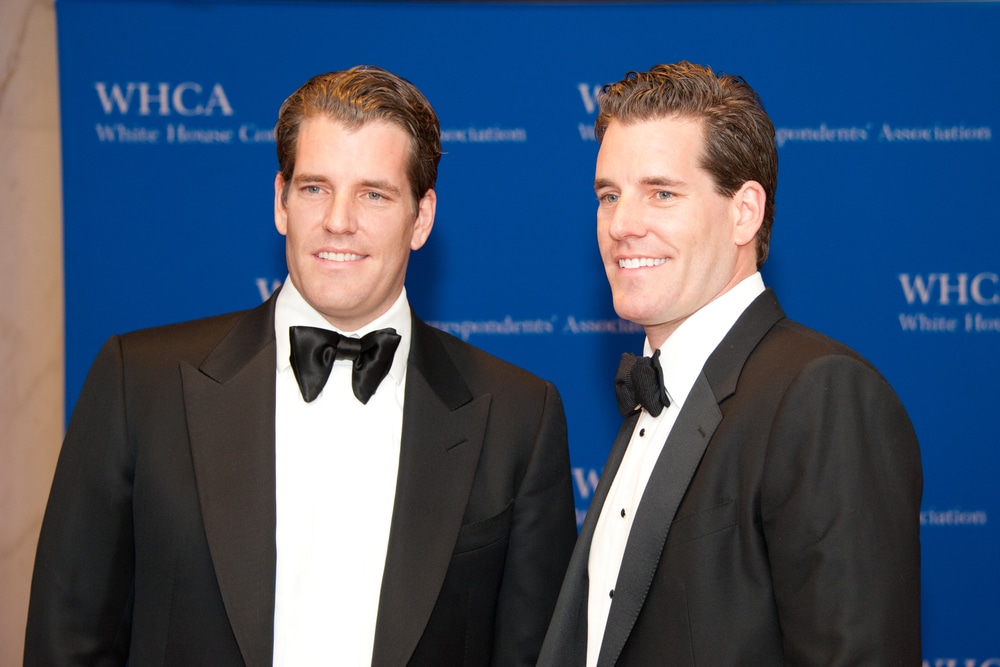

— Tyler Winklevoss (@tyler) July 25, 2025

A Tweet That Modified Every thing

On July 19, Winklevoss accused the banking business of attempting to intestine the Shopper Monetary Safety Bureau’s Open Banking Rule. He argued that banks had been trying to dam customers from sharing their personal information by platforms like Plaid. Shortly after airing his views, Gemini’s re-onboarding talks with JPMorgan reportedly stalled. Winklevoss noticed it as punishment for talking out.

What’s at Stake for Customers and Fintechs

The open banking rule in query falls beneath Part 1033 of the Shopper Monetary Safety Act. It goals to offer customers management over their monetary information and enable them to share it with apps and providers they select. Winklevoss argues that banks are attempting to flip this right into a pay-to-play mannequin by including charges, which might harm smaller fintechs and crypto platforms that rely on easy fiat-to-crypto transfers.

Is This About Cash or Energy?

Winklevoss didn’t maintain again. He framed the banks’ resistance as a option to shield their gatekeeper position within the monetary system. In his view, it’s much less about protecting prices and extra about preserving management over information. He warned that banks are pushing again not simply by lobbying however by authorized motion geared toward delaying or weakening the rule solely.

DISCOVER: 9+ Finest Excessive-Danger, Excessive-Reward Crypto to Purchase in July2025

Others within the Trade Again Him Up

He’s not the one one sounding the alarm. Arjun Sethi, Kraken’s co-CEO, weighed in along with his personal criticism. He mentioned banks are treating entry to person information like a product to be bought, which might lock folks into walled gardens. Nic Carter additionally chimed in, tying the entire state of affairs to what’s usually referred to as Operation Choke Level 2.0, the place crypto corporations lose banking entry with no clear rationalization.

Gemini’s Banking Historical past and Workarounds

Gemini had a relationship with JPMorgan earlier than regulators started urgent banks to distance themselves from crypto corporations in 2023 and early 2024. Since then, the corporate has been searching for different banking companions. This wouldn’t be the primary time the Winklevoss twins needed to pivot. They’ve handled debanking points earlier than and responded by increasing internationally and constructing out completely different cost rails.

DISCOVER: Subsequent 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

JPMorgan’s Silence Says a Lot

The financial institution hasn’t commented publicly on Winklevoss’s declare. Previously, JPMorgan has defended charging charges for entry to its information infrastructure, and CEO Jamie Dimon hasn’t precisely been shy about his mistrust of crypto. Whether or not the pause in discussions was private, political, or procedural, JPMorgan is preserving quiet for now.

This is a part of a wider combat over who will get to regulate monetary information. If charges turn into the norm, it might make it more durable for brand new gamers to compete, and for customers to freely join their financial institution accounts to the providers they need. The result of this battle might form the way forward for open banking within the U.S. for years to return.

DISCOVER: 20+ Subsequent Crypto to Explode in 2025

Be a part of The 99Bitcoins Information Discord Right here For The Newest Market Updates

Key Takeaways

- Tyler Winklevoss says JPMorgan halted Gemini’s banking talks after he criticized banks for opposing open banking guidelines.

- The dispute facilities on Part 1033, which provides customers management over their monetary information and lets them share it with apps.

- Winklevoss and others declare banks wish to cost charges for information entry, locking out fintechs and crypto platforms.

- Trade voices like Arjun Sethi and Nic Carter say this displays a wider push to restrict crypto entry to banking providers.

- JPMorgan hasn’t responded publicly, however the standoff highlights rising stress between conventional finance and crypto corporations.

The submit Winklevoss Calls Out JPMorgan Over Banking Backlash appeared first on 99Bitcoins.