Bitcoin’s latest ascent has been notably calm and measured, standing in sharp distinction to the explosive and chaotic rallies of earlier bull markets. Regardless of buying and selling above its historic progress trajectory, present value motion suggests Bitcoin is way from getting into an overheated part. Whereas long-term holders (LTHs) stay largely inactive, the majority of buying and selling exercise is being pushed by a brand new wave of market individuals.

Bitcoin Development Stays On Observe with Energy Regulation Pattern

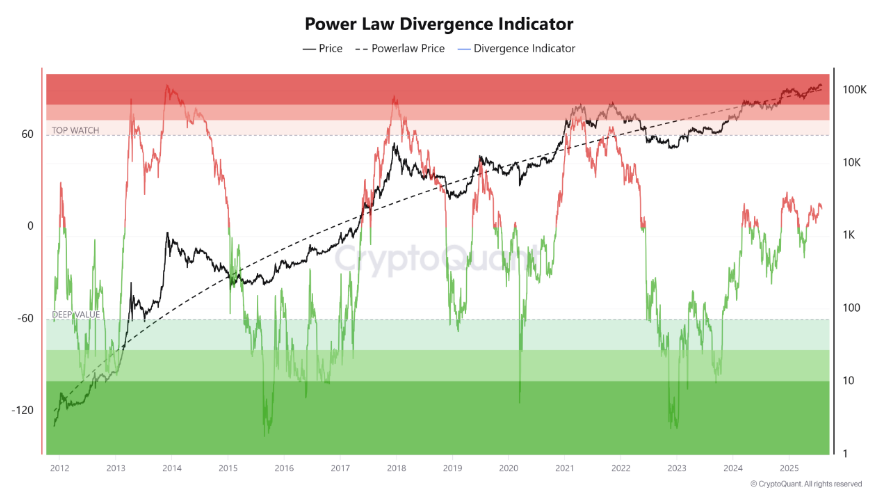

In response to analysis by Arab Chain leveraging information from CryptoQuant, Bitcoin’s value actions are carefully following a Energy Regulation progress mannequin, which forecasts a easy, logarithmic value enhance over time. In contrast to parabolic rallies that lead to dramatic spikes and crashes, the Energy Regulation path creates a steadily curved trajectory, signaling extra sustainable progress.

At present, Bitcoin is positioned above its anticipated progress line however stays nicely under the higher “purple zone” — a threshold that traditionally signifies market overheating. The divergence indicator is optimistic, but considerably decrease than the peaks noticed throughout previous speculative bubbles. Analysts interpret this as an indication of natural market enlargement or presumably the early phases of renewed speculative curiosity.

Divergence Retains Room For Upside

Analysts word that staying under the highest watch zone leaves room for extra positive aspects earlier than panic units in. In prior cycles, costs shot by means of that purple zone after which collapsed.

Right now, Bitcoin is about $50,000 underneath its most up-to-date peak degree. That hole suggests patrons nonetheless have respiration room in the event that they select to push costs larger.

On-chain information from Glassnode reveals short-term holders (STHs) are behind many of the motion. Round 86% of Bitcoin’s spent quantity over the past 24 hours got here from wallets energetic lower than 155 days, totaling $18 billion.

Lengthy-term holders (LTHs) accounted for less than 14.5% of spent quantity, or $3.10 billion. That cut up means newer entrants are driving swings, whereas veteran holders keep largely on the sidelines.

Divergence Leaves Room for Additional Upside

Staying under the important overheat zone gives Bitcoin with ample area for added positive aspects earlier than panic-driven sell-offs sometimes ensue. In earlier cycles, Bitcoin would surge aggressively into the purple zone, triggering speedy corrections as investor euphoria reached unsustainable ranges.

At current, Bitcoin is buying and selling roughly $50,000 under its most up-to-date all-time excessive, leaving a notable hole that optimistic patrons might purpose to shut. This cushion means that whereas the market has room to develop, the ascent is going on at a extra managed and disciplined tempo.

New Entrants Drive Buying and selling Exercise

On-chain information from Glassnode signifies that short-term holders (STHs) — wallets energetic for lower than 155 days — are accountable for a majority of the latest buying and selling quantity. Over the previous 24 hours, STHs accounted for roughly 86% of Bitcoin’s spent quantity, totaling a powerful $18 billion.

Conversely, long-term holders (LTHs) contributed solely 14.5% of the spent quantity, or roughly $3.10 billion. This dynamic reveals a market the place newer individuals are driving near-term value swings, whereas seasoned holders keep a agency grip on their belongings.

Lengthy-Time period Holders Present Unwavering Conviction

The clear divergence between short-term merchants and long-term buyers underscores the deep conviction amongst Bitcoin’s core believers. Traditionally, when LTHs maintain agency, market corrections are typically much less extreme, as these buyers are extra inclined to view value dips as shopping for alternatives relatively than causes to liquidate.

At press time, Bitcoin was buying and selling close to $114,113, following a modest pullback from its latest highs of $118,000. Technical indicators such because the Relative Energy Index (RSI) had declined to 43, suggesting a lack of bullish momentum, however not but signaling oversold situations. In the meantime, On-Stability Quantity (OBV) has been trending downward, pointing to a discount in shopping for strain over the previous week.

Market Cooling, Not Collapsing

Market analysts emphasize that the present mixture of technical and on-chain alerts factors to a cooling part relatively than a crash. Whereas merchants are locking in earnings, there’s no proof of a mass exodus. The prevailing sentiment suggests a maturing Bitcoin market, the place progress is changing into extra measured and fewer vulnerable to the intense volatility that characterised earlier bull runs.

This evolving market conduct displays a broader acceptance of Bitcoin as a respectable asset class. Though wild value swings should happen, the present trajectory signifies a extra sustainable path ahead, pushed by strategic funding relatively than speculative mania.