In a publish shared on TradingView, crypto analyst Xanrox argues that the current bullish cycle is nearly over, pointing to a doable downtrend that may see the Bitcoin value crash to $60,000. This analysis comes as Bitcoin is shopping for and promoting inside a very quiet part, prompting many crypto retailers and crypto analysts to start reassessing its subsequent course.

Xanrox Predicts Bitcoin Prime At $122,000 And Crash To $60,000

The world’s largest cryptocurrency has been hovering merely above the $118,000 value diploma for plenty of days now, struggling to interrupt decisively above this zone however as well as displaying no predominant indicators of a breakdown. No matter this consolidation, market sentiment stays upbeat.

Related Learning

The crypto fear and greed index continues to flash “greed,” and most analysts nonetheless argue that Bitcoin is organising for another leg upward. However, an fascinating technical outlook challenges this bullish consensus and factors a crash warning.

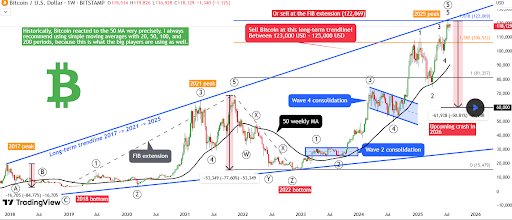

Notably, crypto analyst Xanrox acknowledged a promote signal on the weekly candlestick timeframe chart after Bitcoin reached the 1.618 Fibonacci extension and touched the long-term 2017–2021–2025 trendline, with the latest contact of the trendline aligning to Bitcoin’s present all-time extreme at $122,800.

In accordance with him, the latest contact of this trendline is maybe the best of the current cycle. Furthermore, he well-known that the Elliott Wave development has now completed Wave 5 of a rising wedge and an even bigger Wave 5 impulse switch. As such, a corrective part is about to start.

What’s Subsequent For Bitcoin?

As confirmed throughout the chart underneath, the following predominant switch might presumably be on the very least a 50% decline, with Bitcoin dropping to spherical $60,000 by 2026. This projection depends on earlier value movement, the place Bitcoin launched into 84% and 77% value crashes after touching the trendline in 2017 and 2021, respectively.

The technical setup moreover aligns with statistical data that reveals August and September historically ship elevated selling stress. Xanrox well-known that whereas retailers can watch for extra affirmation, akin to a break underneath the 50-week shifting widespread, he personally believes the best is already in. Big institutions {{and professional}} merchants pay shut consideration to the 20, 50, 100, and 200-period shifting averages.

Related Learning: Bitcoin Fast Squeeze Incoming As Market Makers Set Lure To Go Above $123,000

Xanrox’s outlook is a sharp distinction to the prevailing sentiment amongst crypto merchants. Bitcoin’s current development stays to be displaying vitality on elevated timeframes, and a number of other different totally different analysts see the present consolidation between $117,000 and $119,000 as a base for continuation in direction of $130,000 and previous.

The scarcity of predominant sell-side amount, the company keep above the $118,000 value diploma and the 50-week shifting widespread, and bullish indicators all through altcoins like Ethereum are on-chain indicators that the Bitcoin value nonetheless has further room to run sooner than it reaches a peak value this cycle.

Featured image from Pixabay, chart from Tradingview.com