Key Factors

-

The S&P 500 has cruised to a document excessive and is buying and selling at lofty valuations.

-

The Motley Idiot CEO urges traders to take a special strategy to investing now.

Buyers in inventory markets have witnessed historic volatility in 2025 to this point. After peaking in February, the S&P 500 (SNPINDEX: ^GSPC) index briefly slipped into correction territory in April. Many feared a market crash, however the S&P 500 has as an alternative staged considered one of its most dramatic V-shaped recoveries since and simply hit a document excessive.

The wild trip has left traders questioning whether or not the inventory market is overheated and whether or not they need to spend money on shares now or stay on the sidelines. The concern is warranted. The S&P 500 is presently buying and selling at over 25 occasions earnings, and U.S. shares now account for 65% of all shares worldwide. These are traditionally excessive valuations.

The place to speculate $1,000 proper now? Our analyst staff simply revealed what they consider are the 10 greatest shares to purchase proper now. Proceed »

But, even at these lofty market ranges, you possibly can nonetheless beat the market in the long run if you recognize the place to look. The Motley Idiot CEO and co-founder, Tom Gardner, believes the important thing to beating the market now lies in wanting “the place individuals aren’t wanting.”

Picture supply: Getty Photos.

The kind of shares traders can buy now

In a latest interview, Gardner shared his perspective on the present state of the market and the way traders ought to strategy investing. Whereas recognizing that the markets are at excessive valuations, Gardner maintains that there are nonetheless a whole bunch of fine shares you could possibly purchase now, however they’re in all probability “not probably the most well-known, actively adopted, most richly valued” shares. Gardner believes it is time to be “somewhat extra defensive” proper now and search for investments “the place others aren’t wanting.”

I am saying should you’re in search of good returns over the following 3-5 years that beat the market, I believe it’s essential look the place others aren’t wanting now, and it’s essential search for dividend payers, extra value-oriented investing. At the least the place we’re in valuation now.

So, the place are you able to look to speculate now? Suppose dividends, defensive, and worth shares.

Whereas good dividend shares can generate a gradual stream of passive earnings even throughout turbulent occasions, defensive shares are sometimes recession-proof shares and an effective way to cut back your portfolio threat. Worth shares, in the meantime, commerce for a value decrease than what their fundamentals advantage. As a rule, a few of the most boring companies match two or extra of those three inventory classes, and there are many such shares at present that would beat the market in the long run.

In at present’s setting, three shares come to thoughts.

A 6.9%-yielding protected vitality dividend inventory

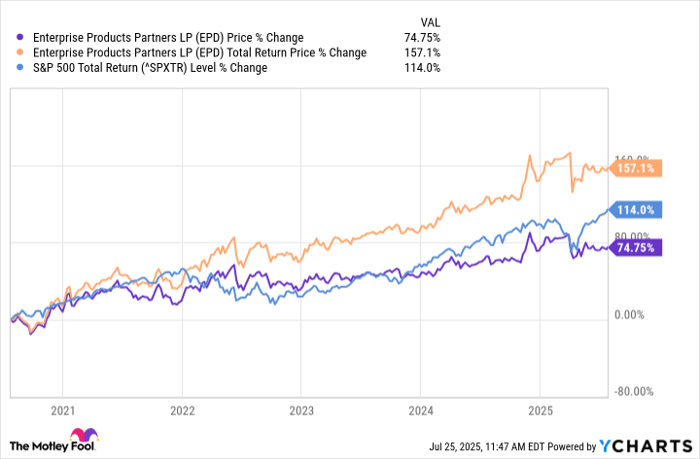

Enterprise Merchandise Companions (NYSE: EPD) is likely one of the largest midstream vitality corporations within the U.S., proudly owning over 50,000 miles of pipeline. It shops, processes, and transports pure gasoline liquids and different merchandise underneath long-term contracts in return for a payment. The enterprise is recession-proof and largely resistant to the volatility in oil and gasoline costs. Furthermore, 90% of the contracts have escalation clauses to offset the results of inflation.

All these elements mixed imply that Enterprise Merchandise can generate regular, predictable money flows and pay common, rising dividends. The vitality big has elevated its dividend for 26 consecutive years, and the inventory yields a hefty 6.9%. With Enterprise Merchandise bringing $6 billion of the $7.6 billion in main capital tasks on-line this 12 months, traders can count on to see regular development in its money flows and dividends, no matter the place the financial system or inventory markets are.

A defensive dividend development wager

Brookfield Infrastructure‘s (NYSE: BIPC)(NYSE: BIP) enterprise can be recession-resilient, because it earns from defensive belongings, akin to utilities, rail and toll roads, midstream vitality, and information facilities. Practically 85% of Brookfield’s funds from operations (FFO) are contracted or regulated and listed to inflation. Whereas that makes its money flows predictable, common acquisitions and recycling of outdated, mature belongings drive money flows greater.

Over the previous 15 years, Brookfield has grown its FFO per unit by a compound annual development price (CAGR) of 15% and its dividend by a 9% CAGR. With the corporate focusing on over 10% FFO development and 5% to 9% annual dividend development in the long run, Brookfield Infrastructure is a superb inventory to personal throughout unsure occasions. The company shares additionally yield 4%.

A beaten-down Dividend King to purchase

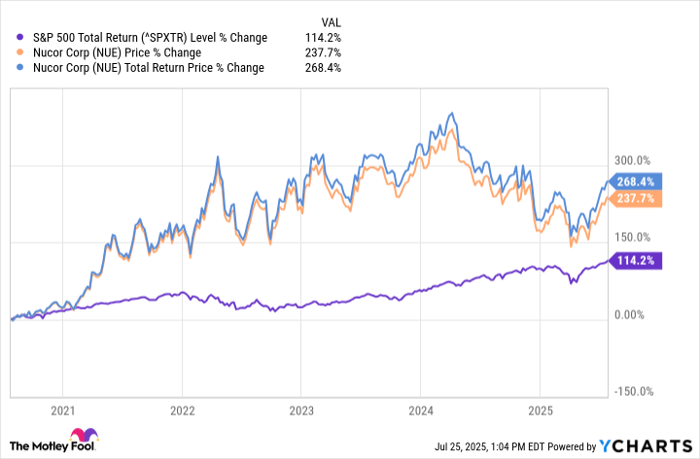

In contrast to Enterprise Merchandise and Brookfield Infrastructure, that are defensive shares, Nucor (NYSE: NUE) is a cyclical inventory. Nevertheless, you would be stunned to see the form of complete returns it has generated lately.

^SPXTR information by YCharts.

Nucor is the most important and most diversified metal producer in North America. Whereas this exposes the corporate to commodity costs, Nucor has sailed by way of turbulent occasions primarily because of two causes. First, it makes use of electrical arc furnaces in metal mills. They’re extra versatile, environment friendly, and cost-effective in comparison with conventional blast furnaces. Second, its mills use scrap as the important thing uncooked materials, which Nucor produces internally.

Vertical integration, a cost-efficient enterprise mannequin, and a powerful steadiness sheet contribute to Nucor’s standing as a Dividend King, having elevated its dividend for 52 consecutive years. With President Donald Trump imposing hefty tariffs on metal imports, Nucor may very well be a strong turnaround story. Buying and selling at 30% off all-time highs as of this writing, Nucor is one worth plus dividend development inventory you could possibly purchase now.

Must you make investments $1,000 in Enterprise Merchandise Companions proper now?

Before you purchase inventory in Enterprise Merchandise Companions, contemplate this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they consider are the 10 greatest shares for traders to purchase now… and Enterprise Merchandise Companions wasn’t considered one of them. The ten shares that made the minimize might produce monster returns within the coming years.

Think about when Netflix made this record on December 17, 2004… should you invested $1,000 on the time of our suggestion, you’d have $636,628!* Or when Nvidia made this record on April 15, 2005… should you invested $1,000 on the time of our suggestion, you’d have $1,063,471!*

Now, it’s value noting Inventory Advisor’s complete common return is 1,041% — a market-crushing outperformance in comparison with 183% for the S&P 500. Don’t miss out on the most recent prime 10 record, out there if you be a part of Inventory Advisor.

*Inventory Advisor returns as of July 21, 2025

Neha Chamaria has no place in any of the shares talked about. The Motley Idiot recommends Brookfield Infrastructure Companions and Enterprise Merchandise Companions. The Motley Idiot has a disclosure coverage.